Cybercriminals are increasingly targeting the banking and finance industry

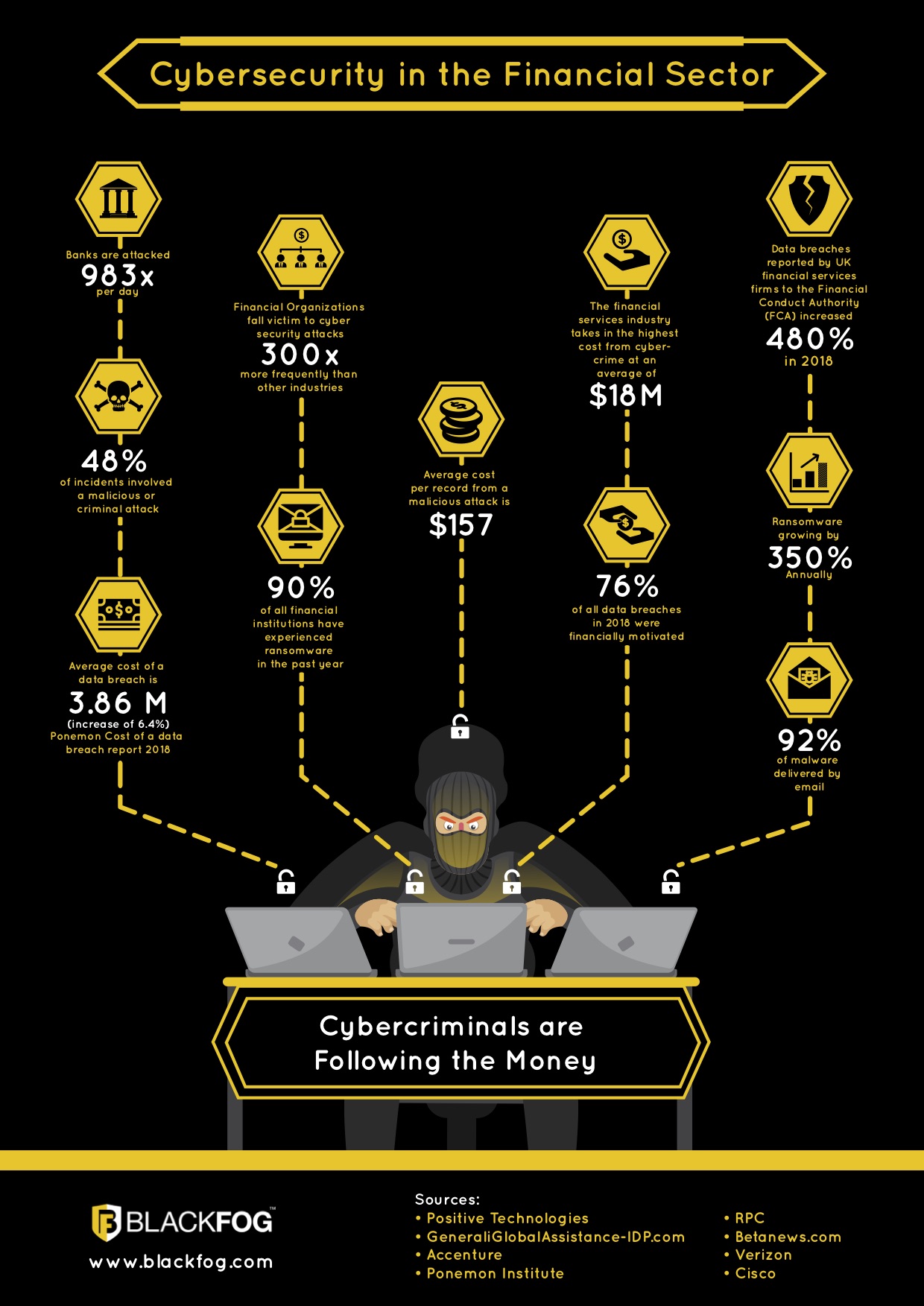

Cybercrime is a lucrative business and the banking and finance industry is under relentless attack from hackers. As cybersecurity attacks continue to grow in both sophistication and frequency and financial services firms become increasingly reliant on customer data and technology to run their businesses, staying one step ahead of cyber criminals is critical.

Ransomware remains the tactic of choice

With more than 90% of financial institutions targeted by a ransomware attack in 2017, it’s clear that ransomware is still the tactic of choice for cybercriminals. With financial gain being the primary motivation for cybercriminals, it’s not surprising that banking and finance organizations are a regular target.

Cybersecurity challenges in banking and finance

- Banking and finance remain a top target for ransomware and malware. Verizon reported that 76% of all data breaches in 2017 were financially motivated.

- Customers are reliant on electronic banking to complete transactions so financial institutions have developed more mobile apps and web portals. This has increased their exposure and risk to cyberattack.

- Mobile banking threats include mobile malware, third-party apps, unsecured Wi-Fi networks, and risky consumer behaviour.

- The financial institution owns the risk, whether or not the institution uses a proprietary or third-party mobile banking application.

- Security breaches can lead to lost revenue, reputational damage, regulatory fines and interruption to operations.

- Maintaining GDPR compliance and mitigating the risk of regulatory fines.

So, how do banking and finance leaders mitigate the risk?

Lots of cyber security solutions can tell you when a breach or attack has taken place and data has been lost. BlackFog stops it from happening in the first place.

BlackFog fills the gap between security solutions that focus on preventing access through intrusion detection systems, such as Firewalls and Anti-Virus/ Malware solutions that remove known infections after they have been discovered. Consisting of multiple layers of defense, BlackFog protects against ransomware, spyware, malware, phishing, unauthorized data collection and profiling.

Prevention is the best form of defense

Cyberattacks and data breaches are inevitable, especially in the banking and finance sector and hackers will find their way in, but with a preventative approach to cybersecurity these threats can be eliminated before the damage is done. Gartner estimates that companies globally could incur $10.5 trillion in costs and lost revenue over by 2025 due to cyberattacks, so all businesses, particularly those in the financial sector simply must prioritize cyber defense.

Benefits for banking and finance

- Prevents cyberattacks before they happen

- Data protection

- GDPR / regulatory compliance

- Privacy

- Cyberattack prevention

- Data breach protection

BlackFog prevents

- Data leaks

- Ransomware

- Hacking

- Identity theft

- Dark Web

- Data profiling

- Phishing

Related Posts

AI in Cybersecurity: Innovations, Challenges and Future Risks

AI will be the next evolution for cybersecurity solutions: What innovations and issues could this present to businesses?

AI-Powered Malware Detection: BlackFog’s Advanced Solutions

Find out everything you need to know about the importance of stopping data theft and the potential consequences of failure.

Texas Tech Cyberattack: 1.4M Records Compromised

The Texas Tech security breach exposed sensitive data of 1.4 million patients. Learn how attackers gained access, the impact on victims, and key lessons for cybersecurity best practices to prevent future educational institutions data breaches.

The 7 Most Active Ransomware Groups of 2024

A comprehensive overview of the top ransomware groups in 2024, looking at their methods, breaches, and industry impacts with detailed technical insights.

Continuous Data Protection: Benefits and Implementation Strategies

What are the key things businesses need to know about ransomware removal and recovery?

The State of Ransomware 2025

BlackFog's state of ransomware report 2025 measures publicly disclosed and non-disclosed attacks globally.